Article

The Ultimate Guide to e-Dirham Card In UAE

Recently, the Ministry of Finance in UAE has launched a new mode of payment called e-dirham. This is a card that looks quite similar to other bank cards such as credit and debit cards and also is used for similar use cases.

Users can fill their card wallet with as much as money the card permits and use it to pay at various stores. Both non-governmental and governmental services in the UAE allow users to pay with an E-Dirham card. Moreover, you can also use it at eDirham G2 Merchants for making payments.

If you are tight on cash, you can also withdraw cash. There are different types of Dirham cards available such as red, green, blue, silver, and gold. Each type of card has its features. Few of the cards are co-branded with Visa ( the payment technology company). Moreover, each card is quite secure and has its features. If this is something that attracts you then stay tuned because in this article we will discuss e-Dirham cards.

Card Types And Features Of e-Dirham Card

There are different types of eDirham Cards or al Haslah cards. Each card comes with its own features, hence anyone can choose any card as per their financial requirements. We have listed 5 types of cards below.

- Blue Alsalah

- Red Alsalah

- Gold Alsalah

- Green Alsalh

- Silver Alsalah

Red Dirham Card allows you to load and reload funds and keep track of all the spending. This card is valid for one year and the cost of this card is AED 6.

Blue eDirham cards are used in Partnership with the Ministry of Finance and are acceptable at various government offices. One can get this card at the cost of AED12.

The Silver card costs nearly 30 USD. It is a personalized card that requires no bank account and has an expiry of almost 3 years.

Gold Card is a personalized card that is also accepted at Government offices and UAE ministries. This is available for both individuals and institutions.

A green card is also a personalized card available for AED 27. This card has an expiration date of 3 years.

- Reload Options and validity Period

There are different channels like mobile app authorized agents and government services centers from where you can reload your e-Dirham card. Each type of e-Dirham card has its own validity period.

- Security Features and protection measures

Each e-Dirham card type uses advanced security measures to protect users and prevent any unauthorized transactions. A few of the security measures used are card authentication, transaction monitoring, and PIN protection.

- Compatibility with various payment channels.

The card is compatible with merchants who accept VISA-branded cards. It can be used anywhere in government offices and private entities.

How To Obtain And Use An e-Dirham Card?

Any individual resident of the UAE can easily apply for an e-Dirham card. The complete process is online and doesn’t require you to travel anywhere.

One can apply for an E-Dirham card from their bank account and credit card. The complete steps are mentioned below.

Time needed: 20 minutes

- Visit Official Website

The first thing you need to do is go to the website (https://www.cbd.ae/personal/cbd-edirham) and click the “Apply Now” button. Soon after you click a new page will open with the eDirham application form.

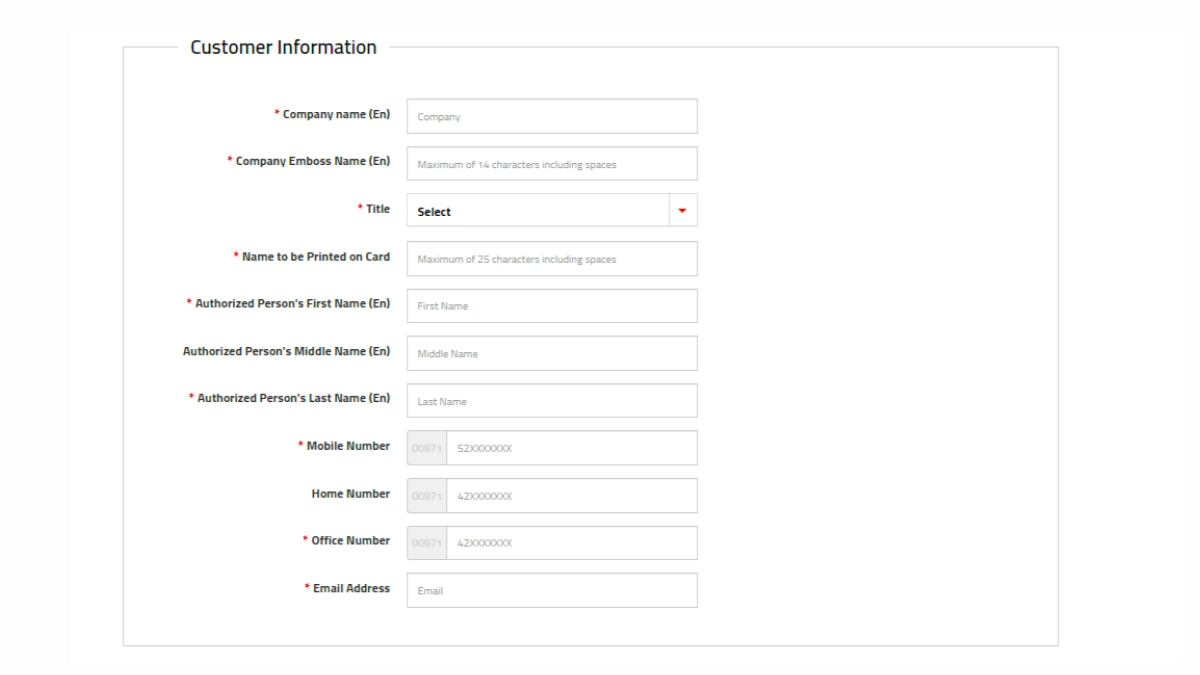

- Fill Information

Fill in all the information about you such as title, name, company name, permanent address, and phone number.

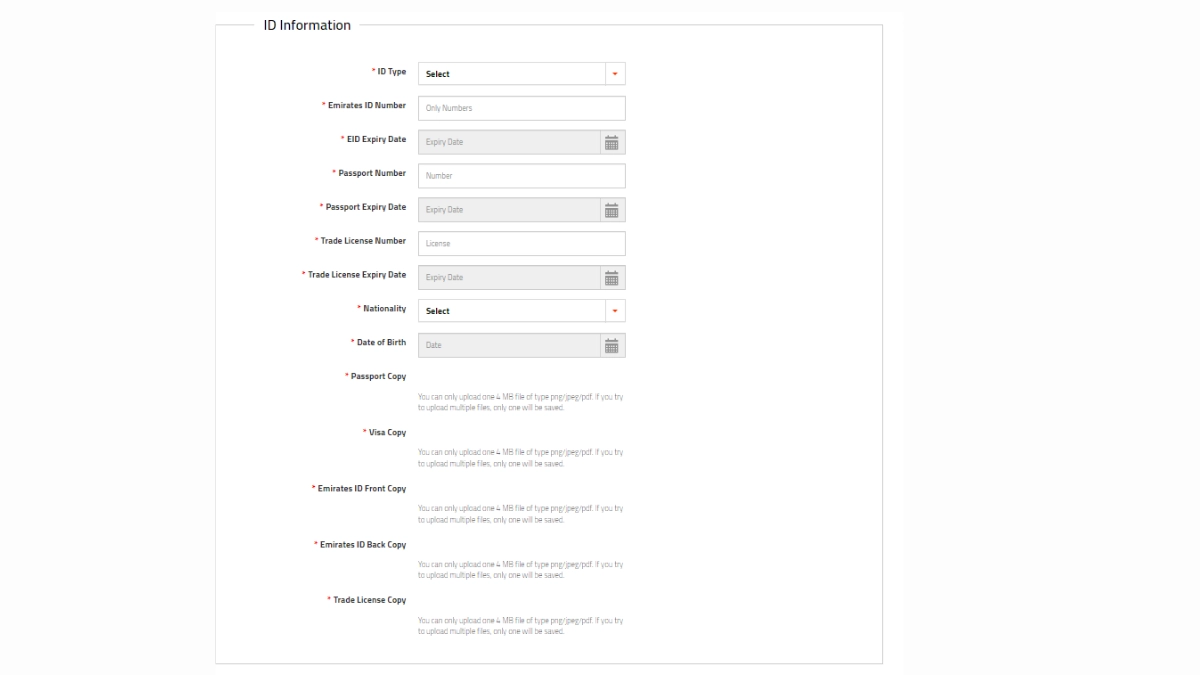

- Submit Emirates ID

Once the application form has been completed, you would need to submit the passport of emirates iD. You can either enter the number of your emirates id or passport and other details requested in the form.

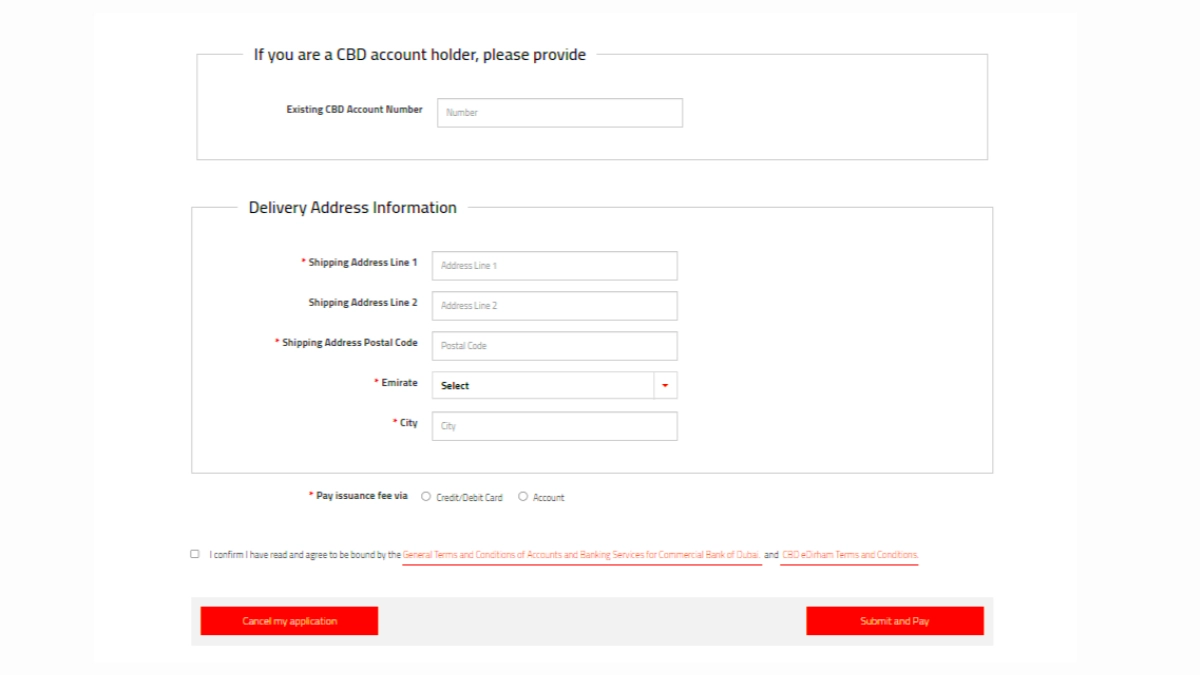

- Provide CBD account number

if you hold your bank account in CBD then you just need to provide the CBD account number and information as needed.

- Choose the payment options

Choose the source from where you will add money to your card. You can choose the bank count option.

How To Use An e-Dirham Card?

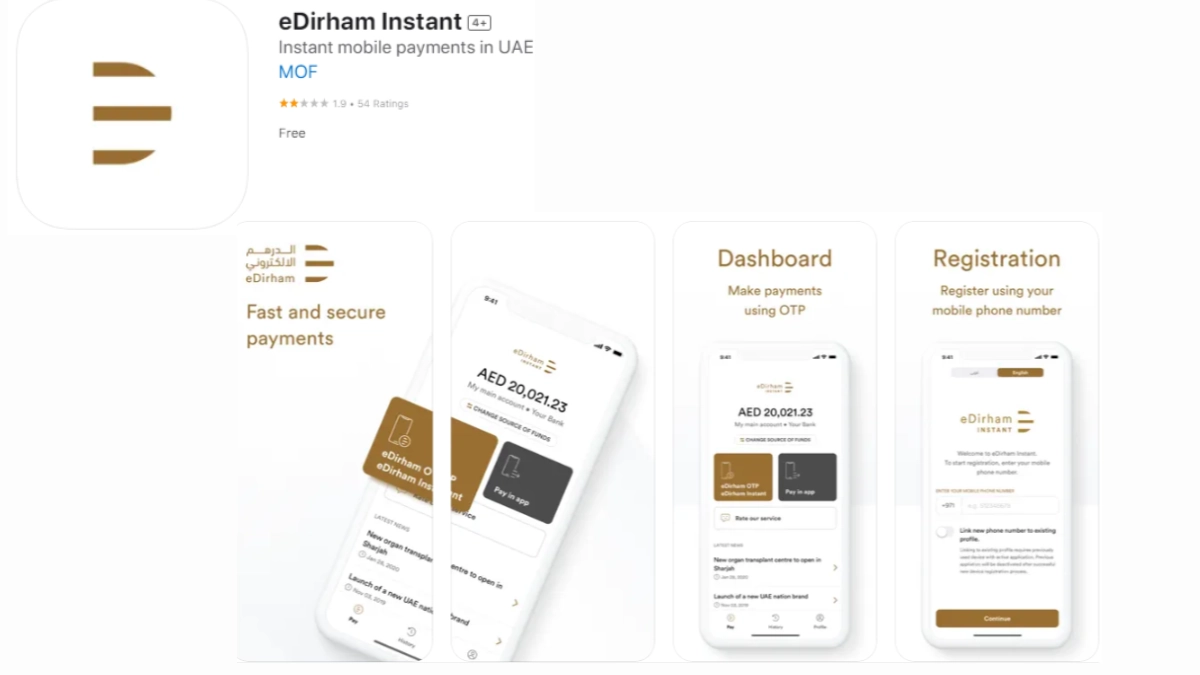

After you have received your e-Dirham card, you can download the mobile application for eDirham and follow the following steps.

Step 1: Choose the language either Arabic or English.

Step 2: enter your registered mobile number with the UAE country code.

Step 3: Verify your identity by entering the one-time passcode on your mobile number.

Step 4: Enter your information like email and name.

Step 5: Enable the face ID if supported by your mobile device else create a passcard.

Step 6: Choose the source from where you will add money to your card. You can choose the bank account option.

Step 7: Scan and enter the e-Dirham card number

Step 8: Enter the access code provided by your bank.

By following the above-mentioned steps you have created your account and can access the benefits and services offered by Al Alahah or E-Dirham card.

Usage Of e-Dirham Cards

In the past few years, the usage of e-Dirham cards has gained a lot of popularity. Almost 70 percent of the increase happened last year in sales.

Accepted Locations And Services That Support e-Dirham Cards

In the UAE, the e-Dirham card is widely accepted by several government centers. It is also used at a lot of government offices to make payments. One can use this card for several use cases like the following.

- Pay the fine for offenses like parking violations and traffic violations.

- Paying fees for immigration-related services, residency permits, and visa applications.

- Paying customs duties, government fees, and taxes.

- Purchasing government documents like driver’s licenses, marriage certificates, and birth certificates.

- Also, it can be used by a lot of merchants while doing online shopping.

Common Scenarios Where An e-Dirham Card Is Used

There are various use cases for e-Dirham cards as listed below.

- You can use it to pay the fees for the government services such as healthcare services, property registration, and registration of companies.

- It can be further used to make payments for educational services like, school fees, exam fees, and library fees.

- A lot of utility providers in the UAE like DEWA(Dubai Electricity and water authority) Allow users to pay bills using e-Dirham cards.

- A lot of retail outlets in UAE also accept e-Dirham cards for making payments.

It is quite important to make sure that the acceptance of e-Dirham cards highly depends on the service provider and merchant. You need to check the supported merchants before you decide to make a payment with an e-Dirham card.

Benefits Of Using e-Dirham Cards For Various Services

A lot of benefits are provided by e-Dirham cards if you make a transaction using them. A few of the key benefits are as follows.

Security: the e-Dirham card uses advanced security methods like PIN code to make the transaction. And also it allows enabling face id or passcode requirements to open the app. This reduces the chances of any fraud or theft.

Convenience: it is quite easy to use to make payments for several government services and other use cases without visiting any bank or needing to take cash. Also if you are tight on cash then you can also use it to withdraw.

Reporting and tracking: one can track all their transactions and generate reports for the accounting use case.

Limitations And Restrictions Of e-Dirham Card Usage

A few of the limitations of the E-Dirham Card are as follows.

Expiration Date: there is an expiry date for the e-Dirham card after which you would need to get a new one as you won’t be able to use the same. It is also important to use all the balance before it expires.

Limited acceptance: E-Dirham cards are widely used for government transactions and might not be accepted by some of the service providers and merchants.

Card fees: There is an issuance fee associated while you’re purchasing an e-Dirham card.

Security And Support For e-Dirham Cards

Security Measures For Protecting e-Dirham Cards

The E-Dirham card leverages various security measures to protect it from any unauthorized excess. A few of the security measures are following.

- Use of PIN(Personal Identification Number) to make payments and all transactions.

- PIN and Chip Technology: there is a microchip in each card that holds information about the card owner and its transactions. To access any of that information, the user needs to enter a PIN.

- Each transaction has a unique token that is needed to process the payment.

- Few of the e-Dirham card transactions have 2FA enabled which requires you to authenticate yourself with either biometric authentication or a One-time password.

Reporting lost or stolen e-Dirham card

If your e-Dirham card is lost or stolen then you need to report it to the issuing bank like CBD if you got it from there. The cardholder would be liable for any unauthorized transaction, so you must report the lost or stolen case as soon as possible.

Dispute Resolution and Customer Support for e-Dirham card

If any dispute or issue happens while you use an e-Dirham card, you should contact customer care or the issuing bank to file the complaint. Once you file the complaint they will do an investigation and based on that action would be taken to resolve all your issues and queries.

Upgrades and Updates to e-Dirham card systems

The e-Dirham card system is regularly updated and upgraded with new functionalities and improved security. Most of these updates are communicated to cardholders through the e-Dirham website, email notifications, and the mobile app. As a cardholder, it is essential for you to always keep the updated version of the app installed on your mobile device.

If you are looking for a prepaid card to use for making payments, then an e-Dirham card is the best choice. This card can be used by both private and public merchants in the UAE. Moreover, advanced security steps are taken to protect the cardholder like tokenization, PIN Technology, two-factor authentication, and a lot more. You can use this card to pay utility bills, educational fees, taxes, and visas.

In the upcoming years, the government will introduce more features to promote cashless and digital payments across all cities in UAE with the use of e-Dirham cards. In upcoming years E-Dirham cards would be the key component to make payments.

Frequently Asked Questions

You can get e-Dirham cards through the different branches of the National Bank of Abu Dhabi or the official website of E-Dirham cards. There is also a mobile application available for both Android and iOS-compatible mobile devices. Also one can get a CBD eDirham card by applying at CBD’s official banking website.

To recharge your eDirham card you can go to the website https://www.cbd.ae/personal/cbd-edirham. There you can enter the card details, amount, and mode of payment to recharge your DIrham card. Also, you can do it from the mobile application.

There are different types of e-Dirham cards but all of them can be used at government offices in the UAE and also merchants that accept Vcardscard. Several local authorities also accept the e-Dirham card for payments

There are different types of e-Dirham cards but all of them can be used at government offices in the UAE and also merchants that accept Vcardscard. Several local authorities also accept the e-Dirham card for payments

Currently, e-Dirham cards are only accepted in the UAE. you can use it for making secure and convenient payments at several government and private entities in the UAE. To make payments outside the UAE there are other options available like credit cards and debit cards.