Banking

Emirates Islamic Bank Swift Code In Dubai, United Arab Emirates

We are in a world of modern technology where everything is at our fingertips. In the past, sending money from one place to another was a daunting task. Moreover, there was a lot of paperwork, thus consuming time. However, now in the present era, you can effortlessly send money anywhere and anytime, sitting in the comfort of your house.

It is because SWIFT Code has broken all the shackles, thus enabling us to send money overseas effortlessly. Moreover, you will also be sure that your money has reached the right destination. Read this article to know all the details about Emirates Islamic Bank Swift Code.

A brief about Emirates Islamic Bank

The Emirates Islamic Bank is one of the most popular banks among the four banks that operate in the United Arab Emirates. It offers services to its customers based on Sharia’s principles. Hence, it is an ideal bank for small businesses and corporates.

The primary motive of the Emirates Islamic Bank is to provide opportunities for individuals and small businesses to prosper.

Since the Emirates Islamic Bank follows Sharia’s Principles, it adheres to giving the best services to its customers. For these reasons, the staff of the bank work with pure dedication and provide the necessary support to its customers.

It also ensures that all transactions are successfully done and provides the best financial support to its customers.

Benefits of Emirates Islamic Bank account

The Emirates Islamic Bank does not function in line with the other commercial banks. One of the benefits of the bank is that it prohibits interest.

Hence, the pressure is not solely on the borrower if he fails to pay back the principal amount of the loan. The risk is shared between the depositor and the shareholders. Following are some of the benefits of having an Emirates Islamic Bank account.

Minimum Monthly Balance

One of the benefits of having an Emirates Islamic Bank Balance is that you can open the account with a minimum monthly balance of AED 100,000.

You can earn interest if you maintain your bank account’s average monthly balance. However, If you fail to maintain the minimum balance of AED 3000, you need to pay a fall-below fee based on the fee structure provided by the bank.

Minimum Monthly Income

You need a minimum income requirement of AED 15,000 to open a bank account with Emirates Islamic Bank. However, transferring some of your salaries to the bank every month would be best to keep the account active.

Initial Deposit

One of the most significant advantages of opening an Emirates Islamic Bank account is that there is no hard and fast rule for an initial deposit.

You can open an account with zero balance which is unlike the features of other commercial banks. Hence, it is a great benefit to the commoners as they can have a bank account with one of the best banks in the United Arab Emirates.

Free Chequebook

The swift code Emirates Islamic Bank offers a free checkbook to all its account holders. Thus, there is no need to pay separately to obtain the checkbook. You can now easily withdraw funds from your bank account without any hassles.

Free Teller Transactions

If you are an Emirates Islamic Bank account holder, you can make unlimited teller transactions according to your convenience. Moreover, you will not be charged the extra service fee.

Related Topics:

🔹ADCB (Abu Dhabi Commercial Bank) Branches And ATMs In Dubai!

🔹Standard Chartered Bank Branches And ATMs In Dubai – Complete List

Local and International Remittances

Being an account holder of Emirates Islamic Bank, you can avail yourself of the Emirates Islamic Bank Swift Code or Swift Code Emirates Islamic Bank.

It is helpful as you can make unlimited local and international transactions without hassles. It is a boon to bank account holders as they can make transactions fast and efficiently.

Free Entertainer Booklet

One of the prime benefits of Emirates Islamic Bank account holders is that they can avail of the free entertainer booklet worth AED 50,000.

Online Banking

Online Banking is of prime importance in the present era. Hence, Emirates Islamic Bank helps its account holders to access their finances from the comfort of their houses.

They can quickly login into their online banking accounts and transact freely. Hence, being a bank account holder, you can transfer and pay bills quickly from anywhere with just a few clicks.

Mobile Banking

One of the most significant advantages of opening a bank account with Emirates Islamic Bank is that you will get mobile app facilities. You can use the app for any transactions and check balances whenever the need arises without any hassles.

Hence, because of the mobile app, account holders can easily access their accounts anywhere. Therefore, Emirates Islamic Bank brings banking services for its account holders at their fingertips. You will not get a better banking facility in other commercial banks.

What is Swift Code?

A swift code is a type of International Bank code that can identify the exact location of a bank. These codes are unique and helpful in transferring money from one location to another. Swift codes are essential when you want to transfer money overseas, and they will ensure that you are transferring money to the right bank and account number.

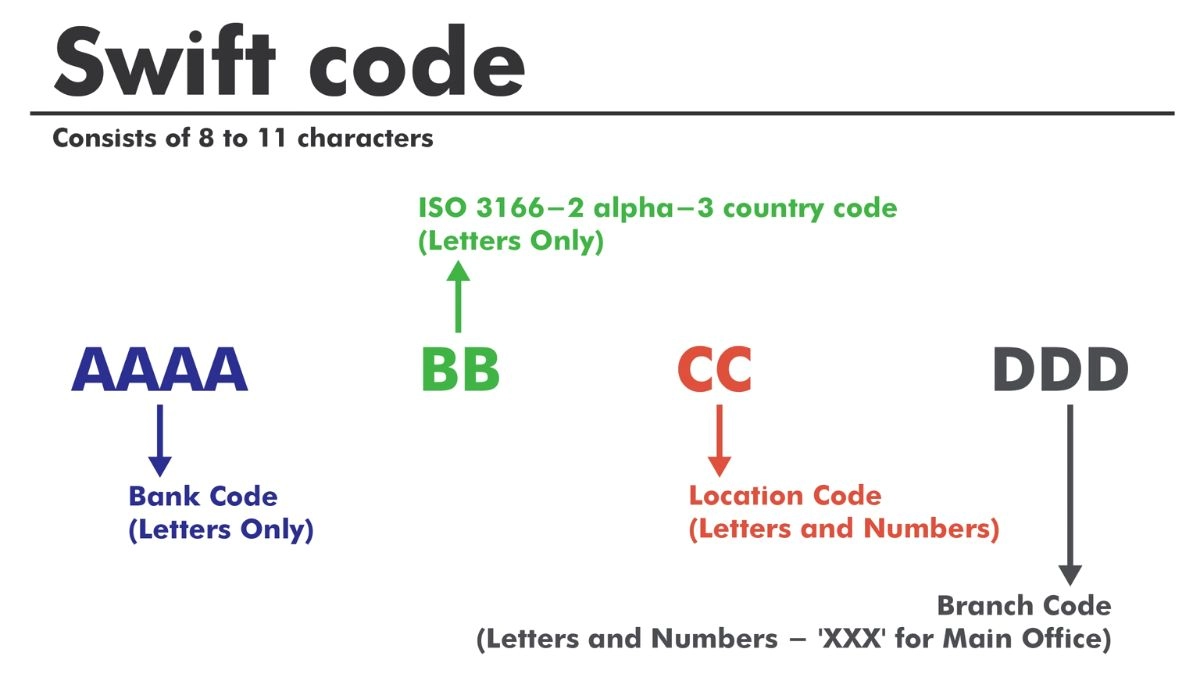

Usually, a swift code consists of eight to eleven characters that specify the Bank code, country code, location, and branch. The bank and country codes are purely alphabetic, while the location and branch codes combine numbers and alphabets.

The Bank code is a four-letter word, usually the short name of a particular bank.

The country code is a two-letter word specifying the name of the country.

The location code specifies the location of the bank. It is a two-letter word comprising numbers and alphabets.

The Branch code is a three-letter word that gives information about the bank’s head office.

The swift code comes into play, mainly when wire transfers money to a foreign land. With the swift code, you can transfer money anywhere in the world. If you do not know the swift code of a particular bank, you can check online for the same.

Swift Code Emirates Islamic Bank

| Branch Name | City | Branch Code | Branch Address | Swift Code |

| Oman Street Branch | Ras Al Khaimah | ROS | Oman Street Branch, Ras AL Khaimah, United Arab Emirates | MEBLAEADROS |

| Al Dhiyafa Road Branch | Dubai | DFR | Al Dhiyafa Road Branch, Dubai, United Arab Emirates | MEBLAEADDFR |

| Bur Dubai Branch | Dubai | BUD | Bur Dubai Branch, Dubai, United Arab Emirates | MEBLAEADBUD |

| King Faisal Street Branch | Umm Al Qaiwan | QFS | King Faisal Street Branch, Umm Al Qaiwain, United Arab Emirates | MEBLAEADQFS |

| Al Borj Avenue Branch | Sharjah | SBA | Al Borj Avenue Branch, Sharjah, United Arab Emirates | MEBLAEADSBA |

| Fujairah Branch | Fujairah | FUJ | Fujairah Branch, Fujairah, United Arab Emirates | MEBLAEADFUJ |

| Al Riqa Branch | Dubai | RIQ | Al Riqa Branch, Dubai, United Arab Emirates | MEBLAEADRIQ |

| Murshid Bazar Branch | Dubai | MRD | Murshid Bazar Branch, Dubai, United Arab Emirates | MEBLAEADMRD |

| Al Jawazat Street Branch | Al Ain | AJS | Al Jawazat Street Branch, Al Ain, United Arab Emirates | MEBLAEADAJS |

| Sh. Rashid Street Branch | Abu Dhabi | ADC | Sh. Rashid Street Branch, Abu Dhabi, United Arab Emirates | MEBLAEADADC |

The Emirates Islamic Bank Swift Code is essential to transfer money worldwide. However, the bank follows an entirely different principle, unlike the other commercial banks. The bank will only pressure you if you are an account holder and repay the principal amount for specific reasons.

Instead, it will ensure that the loss is shared equally among the shareholders and the borrower. Moreover, since it follows Sharia’s Principles, you will not be charged any interest if you apply for a loan.

The services rendered by Emirates Islamic Bank are above the other commercial banks as they try to satisfy their account holders. They have a group of dedicated staff who are experienced, skilled, and helpful. It is a boon to have an account with the Emirates Islamic Bank in the United Arab Emirates.

Frequently Asked Questions

In the present era, finding the swift code of a particular bank is like a piece of cake. You can get the swift code number of your bank from your account statement or use the Swift or BIC finder online. You need to enter the Bank name and the location of the country. Once you click the search option, you will get the Swift code of the required bank.

A Mudraba is a person who refers to your investment on your behalf. He is a skilled person who can advise you on the right path.

According to Islamic law, you can only use the money for purchasing. You cannot make money from money, as it is against Islamic principles.

The first four letters of the swift code signify the Bank code. Hence, the Emirates Islamic Bank Swift Code’s first four letters are MEBL

A swift code generally contains eight to eleven characters, a combination of numbers and alphabets.