Article

How To Easily Redeem VAT Refund In Dubai – Complete Guide

The UAE is a shoppers’ paradise, with flashy malls, gold souqs, and luxury boutiques offering the greatest goods from across the world. Tourists certainly wish to take advantage of the country’s shopping options when there.

The country’s move to reimburse VAT paid by visitors on their transactions is a boon to the travel, tourism, and retail industries. On January 1, 2018, the UAE implemented VAT. Following the global trend of exempting tourist transactions from VAT, the Federal Tax Authority (FTA) began offering VAT refunds to visitors on November 18, 2018.

So, how can you quickly redeem your VAT refund in Dubai? Continue reading to learn everything there is to know.

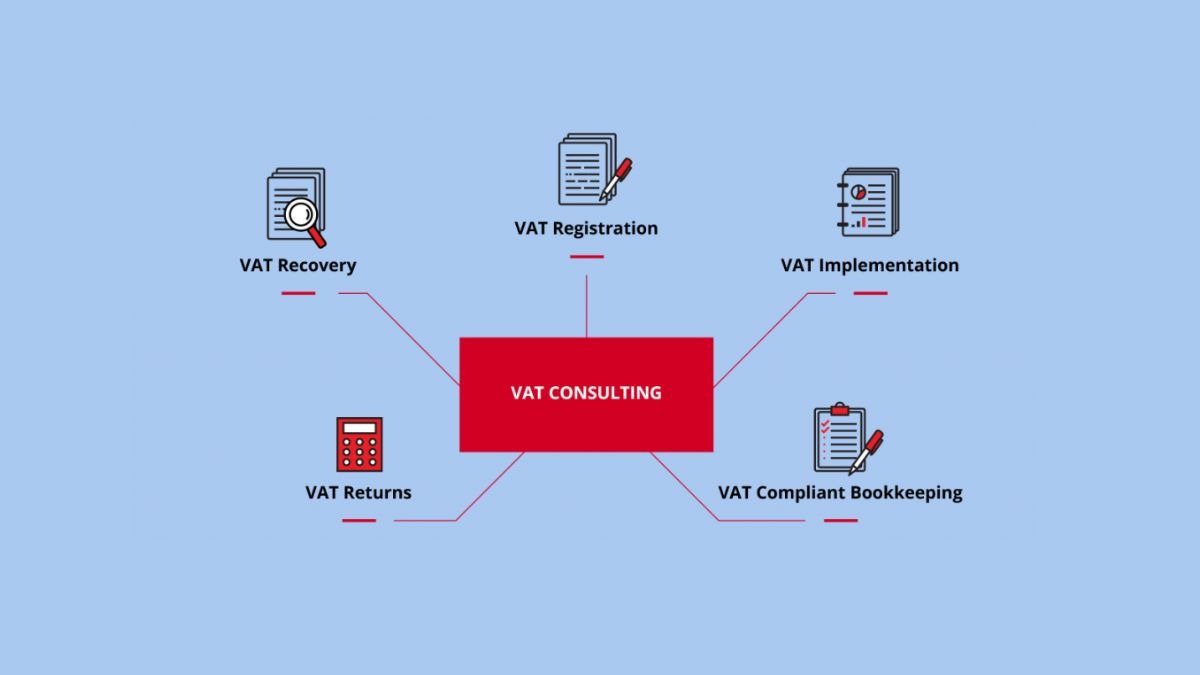

What is VAT?

VAT is a tax levied on purchasing or using products and services. Now at the point of sale, a 5% VAT is imposed. Businesses collect and remit taxes on the government’s behalf. Tax is a fee levied by the government on products, services, earnings, and other transactions to fund public services and expenditures.

There are two types of taxes: direct taxes, which are paid directly to the authorities by the taxpayer, and indirect taxes, which you pay to the government through a middleman who gathers the tax from taxpayers on the government’s behalf.

The VAT is an indirect tax on the purchase or use of services and products. The government levies it at each stage of the supply chain. The expenses of VAT are borne by end users, while registered enterprises collect and account for VAT on behalf of the government.

What is the Dubai VAT system?

Consider the following scenario to understand how the Dubai VAT system works:

A smart TV set producer sells a television to a distributor for AED 1000. The producer collects a 5% VAT, which is AED 50, from the distributor on the government’s behalf under the new tax structure. The distributor then pays AED 1050 in total.

The distributor raises the sales price to AED 2000 before passing it on to a retailer. The distributor collects 5% VAT, which is AED 100, on the government’s behalf from the retailer while simultaneously obtaining reimbursement of the VAT paid to the producer in the previous phase. AED 2100 is paid in whole by the retailer.

The retailer raises the sale price to AED 3000 before selling it to the final customer. The retailer charges the final customer 5% VAT, that is AED 150, and receives a reimbursement of the VAT paid to the distributor in the previous phase. The smart TV set costs a total of AED 3150 to the final user.

At each phase of the sales transaction, the government levies a value-added tax, and the registered firm gets a reimbursement (or tax credit) on the VAT paid in the previous phase. For the sale of merchandise and services in Dubai, the Federal Tax Authority (FTA) has set a fixed VAT rate of 5%.

Why was the VAT implemented in Dubai?

The United Arab Emirates provides great public services such as healthcare, education, public transit, and social services. Implementing a VAT will enable the federal government to diversify its revenue streams while maintaining a high quality of living for UAE inhabitants as a whole.

VAT adoption is estimated to yield AED 12 billion in revenue during the first year and up to AED 20 billion in the second year.

Why should you pay the VAT in Dubai?

👉As a tourist

At a 5% tax rate, the VAT refund may appear little, especially for individuals who are particular about searching for VAT-exempt stores, collecting bills, and asking for refunds. VAT refunds on modest purchases are insignificant and might not be worth the hassle.

However, because Dubai is an outstanding international destination for shopping, You should consider the tax savings in terms of the cost of products purchased. Take the scenario of a traveler who spent AED 100,000 on luxury items. They will save AED 5,000 by purchasing from a retailer registered with the FTA for the VAT return scheme.

Tourists can get a refund through authorized procedures. Tax savings do not necessarily have to come from a single significant purchase; the tax accumulation of one’s purchases of products during one’s stay in Dubai might add up to a considerable sum and be worth a refund.

👉As a business owner

VAT is an indirect tax levied on the supply of goods and services. The standard VAT rate in Dubai is 5%. As a business, the government requires VAT if you make revenue of more than AED 375,000, and optional for businesses with a turnover of more than AED 187,500.

VAT is a tool for the government to generate cash and utilize it to improve public services and the country’s overall well-being. The following are some of the reasons why you should pay VAT in Dubai.

👉It provides precision and dependability

When it comes to business, we plan every step, set strategic goals, and execute to meet targets. Because having point precision is key in business, correct methods are essential to keep you going.

On the other hand, VAT assures its services’ correctness and dependability by providing you with the necessary information on VAT registration, filing, refunds, etc. You can count on them for seamless operation.

👉VAT refunds are possible

When most people think of taxes, they see paying money to the government. The tables may turn if you offer to pay VAT in Dubai. The opportunity to collect VAT refunds is one of the advantages of VAT registration. When your company buys items, you can recover VAT on them.

In addition, your company can recover VAT on services paid for during the year. If your business has incurred significant costs over the year, the amount you recoup may be substantial. You might receive a sizable refund when you file your VAT return after such costs.

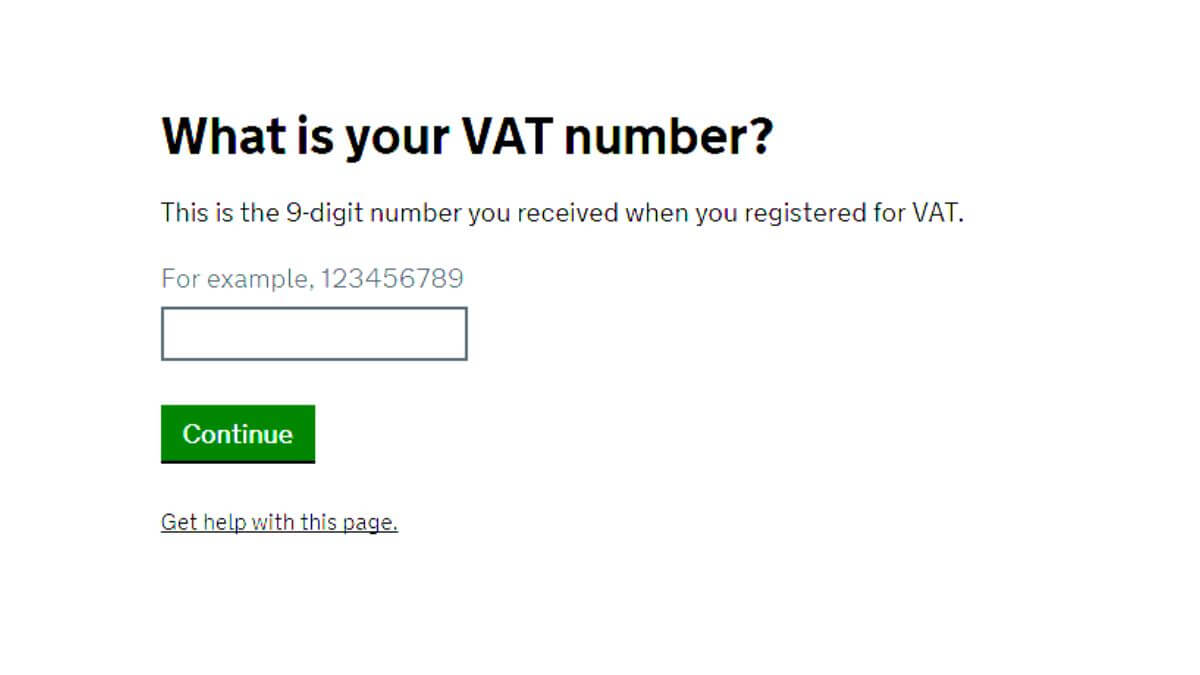

👉The government assigns a VAT registration number to you

While this may appear minor, it is rather significant. It is related to the first advantage of a better picture. However, it goes beyond your company’s image. A VAT number may do miracles for your image if you own a small business.

It demonstrates that you are an active business owner. It establishes your reputation and trustworthiness with potential clients. A VAT registration number may significantly change your business.

What items can you process for VAT refunds?

Except for the following categories, any VAT-applied items or goods are eligible for a tax refund:

- Aircraft, automobiles, and boats.

- Products consumed partially or entirely in the country or any GCC Implementing State.

- Goods that travelers do not have on hand before they depart from Dubai.

We recommend allowing ample time before departure to conduct validations. For example, get to the airport an hour or so before your flight’s departure time.

How much is the VAT refund rate?

Tourists are entitled to 85% of their total VAT payment. Government charges an administration fee of the remaining 15%. Also, cash returns are limited to AED 7,000 per day under new Federal Tax Authority restrictions.

The government did this to lessen shopper dependency on cash during monetary operations and to assist them in taking advantage of the country’s technological achievements. If you do the transactions using a credit card, there is no limit on the maximum recoverable amount.

Related Topics

🔹VAT Rule Update: UAE Announces Changes In Certain Rules, Beginning January 2023

🔹Best Places to Celebrate New Year’s Eve in Dubai 2022-23

Requirements for VAT refund

The following data is necessary throughout the validation process for the Dubai VAT refund application:

- Tax refund tag on a sales transaction receipt or tax invoice (minimum spend of AED 250)

- Documentation about the trip.

- The boarding pass.

- Bought items (you must submit the purchased products at the validation counters before checking in bags).

It is important to note that you must depart the country within six hours of completing the authentication procedure for a VAT refund in Dubai. Failure to do so may result in the cancellation of a refund. You can still claim your tax refund if you repeat the tax refund confirmation process.

How to easily redeem VAT refunds in Dubai?

Tourists can only claim a refund of the VAT they paid for their purchases at outlets and points of sale enrolled under the Dubai Tax Refund Scheme for Tourists. Visitors can access their VAT refund scheme using an electronic system at specific locations. A computerized system will be able to evaluate which taxes are eligible for a return, and you will get a refund appropriately.

Step-by-step guide on how to redeem VAT refunds in Dubai

- Tax-free status. When you’re done shopping, the seller will affix a “tax-free tag” to your receipt. This “tax-free tag” is critical since it will allow you to take advantage of the Tourist Refund Scheme in Dubai.

- Validation. It is vital to remember that validation is required to take advantage of the Tourist Refund Scheme in Dubai. You will need to produce your passport/boarding pass for this purpose, and They will perform extra checks to guarantee that you have done everything correctly.

- Refund procedures. There are two refund types available under the Tourist Refund Scheme in Dubai: cash and credit. The Planet tax-free personnel will assist you in obtaining your reimbursements through the Tourist Refund Scheme. The refund is only available to the owner.

Conditions to Comply

The FTA has explicitly indicated the conditions for travelers in Dubai to receive VAT refunds. As long as travelers buy things from registered businesses around the city, they can receive a VAT refund.

Some of the conditions are:

- You must fulfill tourists’ purchases within the UAE’s borders.

- The visitor must expressly state that they intend to depart the country within 90 days of the date of supply, together with the acquired supplies.

- The tourist must export the products out of the UAE within three months of receiving them.

- You must submit a refund claim within 90 days after purchase.

- The tourist must buy the items from a registered retailer in the system.

- A tourist’s minimum purchase for VAT reimbursement is AED 250.

- The maximum cash refund amount is AED 7,000.

- Tourists will get a refund of 85% of the entire VAT amount paid, less an administration cost of AED 4.8 per tax-free form.

Who can redeem the VAT refund?

Not all tourists are eligible for VAT refunds on products purchased in Dubai. Traveling visitors must fall under one of these categories under current legislation to qualify for a VAT refund in Dubai:

- Tourists must be age 18 and above.

- Must be neither UAE nor GCC nationals.

- Must not be a crew member on planes departing the United Arab Emirates.

That’s all there is to know about VAT refunds in Dubai. In addition, once you have completed the application stage, The Dubai government will handle the reimbursement form following the FTA process.

The FTA will notify you through email of the outcome of your application. The government will return the cash after your claim is validated. They will send a confirmation email to you.

Frequently Asked Questions

You must leave the UAE within three months of receiving the tax invoice. If requested, you must personally present the appropriate products. You can then obtain a cash refund within one year of the day they validate the refund request.

If it says the payment is in progress, the VAT refund is in the works. Depending on the card issuer, this can take up to 9 days to appear in your bank and up to 3 weeks to appear on your bank statements.

Yes. Prepare your claim by placing your receipts and contact information in an enclosed envelope labeled ‘HMRC VAT claim’.

No. To claim your returns, you must file a VAT return to HMRC every three months.

VAT exemptions are generally granted in Dubai for specific financial services, housing investment and supply of acreage, local travelers, etc.